Post by : Rajat

Anil Ambani 2.0: What’s Powering the Turnaround of Reliance Power and Reliance Infra?

Once counted among India’s most influential industrialists, Anil Ambani had, for years, appeared to be fighting a losing battle against mounting debts, legal troubles, and market setbacks. However, the tides seem to be turning. Anil Ambani 2.0: What’s powering the turnaround of Reliance Power and Reliance Infra? This question is now drawing renewed attention as both companies show promising signs of recovery.

The narrative of Anil Ambani’s decline was well-publicized: massive liabilities, stock plunges, and the contrast with the ever-growing empire of his brother Mukesh Ambani. But recent developments suggest a strategic reset that is slowly but surely restoring investor confidence in Reliance Power and Reliance Infrastructure.

A Brief Background: The Rise and Fall

Anil Ambani inherited the reins of key non-telecom segments of the Reliance empire after the split from his brother in 2005. Over the next few years, he built a wide-ranging portfolio including power, infrastructure, and financial services. However, aggressive expansion, mounting debt, and changing regulatory environments led to a rapid downturn.

By 2020, Reliance Power and Reliance Infra were struggling with huge debt burdens, litigation, and failing investor sentiment. Anil Ambani himself declared in court that he was financially insolvent.

Yet here we are, in 2025, talking about Anil Ambani 2.0—and for good reason.

Strategic Debt Restructuring

One of the major factors behind the turnaround is the focused and disciplined approach to debt restructuring. Both Reliance Power and Reliance Infra have made significant progress in reducing their liabilities through asset monetization, settlements with lenders, and improved operational efficiency.

Reliance Infrastructure, for instance, recently completed several debt resolution agreements with Indian banks, easing pressure on its balance sheet. This allowed the company to resume operations on delayed projects and bid for new ones with improved financial standing.

Similarly, Reliance Power has managed to bring down its debt through internal accruals and strategic stake sales, while also seeking shareholder approval to raise funds via preferential allotments.

Fresh Equity Infusion & Institutional Backing

A major turning point in the revival story came when Anil Ambani, along with key promoters, committed to infusing fresh equity into the group companies. This capital injection not only helped in restoring liquidity but also signaled renewed confidence from promoters themselves.

What’s even more crucial is the quiet entry of institutional investors and mutual funds showing interest in these stocks again. The re-rating of both Reliance Power and Reliance Infra by brokerage firms highlights the perception shift that’s underway.

Legal Clarity & Regulatory Progress

For years, the group companies were bogged down by pending legal disputes—particularly involving project delays, regulatory clearances, and financial defaults. In 2024, a series of favorable rulings by regulatory bodies and courts have cleared many of these hurdles.

A key example is the arbitration win in favor of Reliance Infrastructure regarding the Delhi Airport Metro Express project, which brought in a compensation award running into hundreds of crores. This not only boosted the company’s financials but also morale among investors.

Operational Focus & New Projects

Unlike the scattergun approach of the past, Anil Ambani 2.0 seems to be about operational focus. Reliance Infra is now doubling down on its core segments—transport infrastructure, EPC (engineering, procurement, construction), and defence. The company has bid for and won multiple urban metro projects and is eyeing future opportunities in India’s massive infrastructure push.

Reliance Power, meanwhile, is focusing on stabilizing and maximizing capacity utilization across its coal and solar plants. With India's growing energy needs, this segment holds potential, especially if the company can maintain cost discipline.

The Market Response

The stock markets have noticed. Both Reliance Power and Reliance Infra have seen substantial appreciation in share prices over the past 12 months. While still volatile, the upward trend suggests renewed interest from retail and institutional investors alike.

The shareholding patterns are also shifting, with a slow but noticeable return of long-term investors, indicating increased faith in the management’s restructuring efforts.

A Leaner, Sharper Leadership Approach

One of the most striking elements in this revival journey is Anil Ambani’s changed leadership style. Gone is the flamboyance and aggressive expansion of the early 2000s. Instead, Anil Ambani 2.0 reflects a more grounded, cautious, and focused approach—prioritizing value creation over volume.

Insiders claim he’s now deeply involved in day-to-day operations and closely monitoring cost efficiencies and project timelines.

What Lies Ahead?

The road ahead is not without challenges. Both Reliance Power and Reliance Infra still carry legacy debt and must deliver consistent performance to retain investor trust. Additionally, competition is fierce, and market dynamics can shift rapidly.

However, the key ingredients for a successful turnaround—clear strategy, promoter commitment, debt resolution, and operational focus—are now in place.

Disclaimer

The information provided on GCCNews24 (GCCNews24.com) is for general informational purposes only. While we strive to ensure that the news, opinions, and other content published are accurate and up-to-date, GCCNews24makes no representations or warranties of any kind, express or implied, regarding the completeness, accuracy, reliability, or suitability of the information contained on the website for any purpose.

#trending #latest #AnilAmbani #ReliancePower #RelianceInfra #BusinessRevival #CorporateComeback #IndianStocks #DebtRestructuring #PowerSector #InfrastructureIndia #GCCNews24 #GCCN24 #GCCNews24 #MiddleEastNews #GCCN24Updates #GCCBreakingNews #NewsNetwork #GCCNewsToday #GulfNews #LatestNewsGCCN24 #NewsFromGCCN24 #GCCN24Journalism #NewsCoverage #GCCNewsPortal #GCCN24Reports #NewsHub #RegionalNews #GCCN24Watch #NewsFlash #GCCNewsNetwork

South Korean Workers Return After US Immigration Raid Shock

A plane brought back 300 South Koreans after a US raid. Seoul now seeks new visa rules to protect wo

Microsoft And OpenAI Sign New Deal To Shape Future Partnership

Microsoft and OpenAI sign a new deal to reshape their partnership, supporting OpenAI’s move toward a

Nepal Gen Z Protests Burn Parliament And Luxury Hotels In Chaos

Massive Gen Z protests in Nepal target elites’ wealth, burning parliament and top hotels, causing de

ITF Appoints Tie Break Tens As Official Partner For Junior Tennis

The ITF has named Tie Break Tens its official partner, integrating the 10-point tiebreak format into

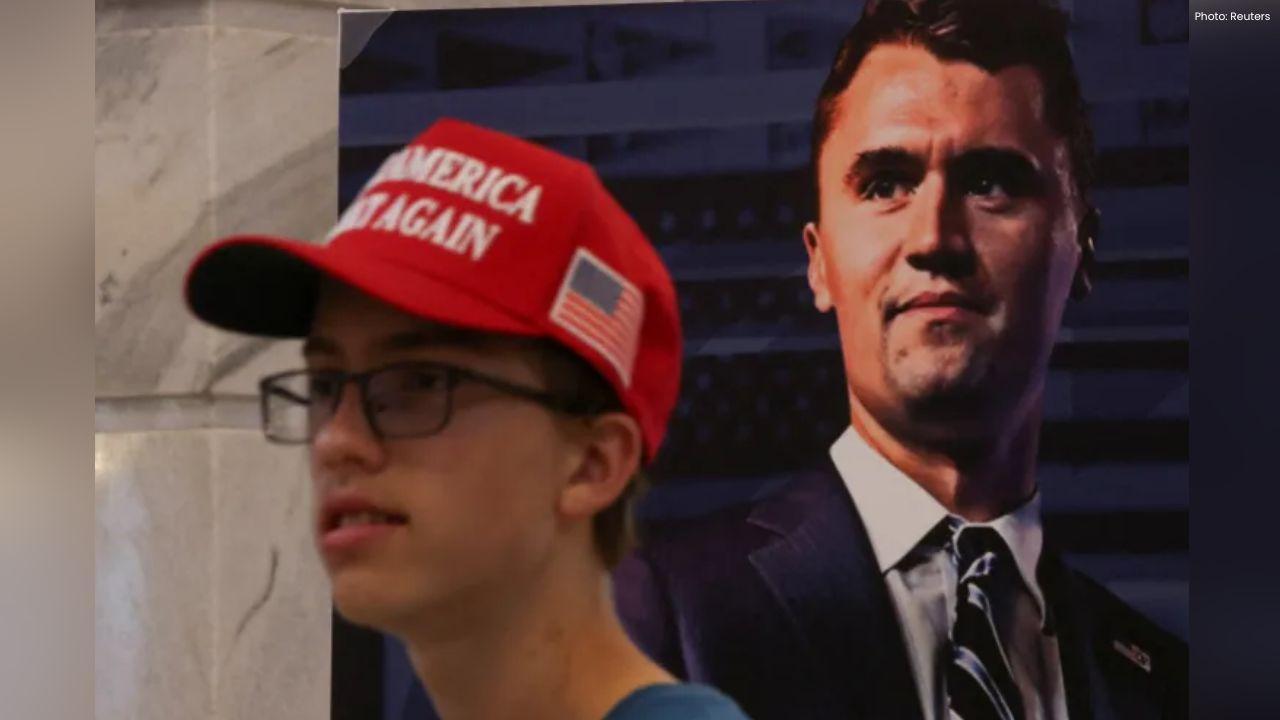

Charlie Kirk Shot Dead In Utah, Police Seek Help To Find Killer

Right-wing activist Charlie Kirk was shot dead at Utah Valley University. Police seek public help as

Indian Airlines Resume Flights to Kathmandu After Nepal Unrest Ends

Indian airlines resume normal flights to Kathmandu as Tribhuvan Airport reopens, helping stranded pa