Post by : Sami Al-Rahmani

The Middle East property market has become one of the world’s most dynamic investment destinations. From the futuristic skyline of Dubai to the expanding developments in Saudi Arabia, Qatar, and Bahrain, the region offers unmatched potential for investors seeking stable returns and long-term growth.

However, buying property in the Middle East as a foreigner isn’t as simple as it seems. While many countries have opened their doors to foreign ownership, there are specific legal processes and compliance steps that must be followed to ensure a safe, lawful, and profitable transaction.

This article outlines the seven crucial legal steps every foreign investor must know before purchasing property in the Middle East.

Before purchasing property, it’s essential to understand who can legally own real estate and where. Each country in the Middle East has its own laws regarding foreign ownership.

United Arab Emirates (UAE):

In Dubai and Abu Dhabi, foreigners can buy property in designated freehold areas such as Downtown Dubai, Palm Jumeirah, Yas Island, and Saadiyat Island. Ownership grants full rights to sell, lease, or inherit the property.

Saudi Arabia:

The Kingdom now allows foreigners to buy property under specific conditions, particularly in non-restricted zones. However, Mecca and Medina remain off-limits to foreign buyers.

Qatar:

Non-Qataris can own property in specific zones like The Pearl-Qatar, Lusail, and West Bay Lagoon, with residency benefits for owners.

Bahrain and Oman:

These nations also permit foreign freehold ownership in selected projects, often coupled with residency privileges.

Always consult with a local real estate lawyer or property consultant to confirm current regulations, as ownership rules evolve frequently.

One of the biggest risks in foreign property investment is purchasing from an unapproved developer or an unregistered project.

Before making any commitment, check:

Whether the developer is registered with the relevant land department or municipality.

If the project has government approval and all required permits.

Whether there are any pending disputes or legal issues associated with the development.

For instance, in Dubai, investors can verify these details through the Dubai Land Department (DLD) or the Real Estate Regulatory Agency (RERA). Doing so ensures that your investment is legitimate and protected by law.

Legal due diligence is a non-negotiable step when buying property abroad. It involves verifying all documents and ensuring there are no hidden liabilities.

Make sure you obtain and review:

Title Deed: Confirms legal ownership of the property.

No Objection Certificate (NOC): Issued by the developer confirming there are no outstanding dues.

Sales and Purchase Agreement (SPA): Outlines payment terms, ownership rights, and penalties.

Developer License: Proof that the developer is legally authorized to sell units.

Mortgage or Debt Clearance: Ensures the property isn’t under bank debt or legal dispute.

Engaging a licensed property lawyer familiar with the local system will safeguard your transaction and ensure compliance with regional laws.

Many Middle Eastern countries have introduced escrow laws to protect buyers’ money during construction projects.

An escrow account is a regulated bank account where buyers deposit funds that are only released to the developer upon meeting specific construction milestones.

For example:

In Dubai, RERA mandates that all payments for off-plan projects must go through an escrow account.

In Qatar and Bahrain, similar laws ensure transparency and protect investors from fraud or project delays.

Always confirm that your payments are made to an approved escrow account, not directly to the developer or agent.

Depending on the country and property type, you may need specific approvals:

Foreign Ownership Permit: Required in some Gulf countries for non-citizens buying in designated zones.

Residency Visa or Golden Visa: Many countries offer residency benefits to foreign investors.

In Dubai, investing at least AED 2 million can qualify you for a 5-year Golden Visa.

Qatar and Bahrain offer similar investor visas tied to property ownership.

Make sure all necessary approvals are obtained before finalizing the sale to avoid future legal complications.

Once the sale agreement is signed and payments are made, the next step is registering your property with the relevant authority.

Here’s how the process typically works in the UAE and other Middle Eastern markets:

Submit all required documents, including the title deed, ID copies, and NOC.

Pay the property registration fee (commonly 2%–4% of the property value).

The land department issues an updated title deed in your name, confirming legal ownership.

Registration fees and taxes vary by country, so always check with local authorities or your real estate agent beforehand.

While many Middle Eastern countries have tax-free policies, property ownership still involves certain financial considerations:

Property Transfer Fees: Usually between 2% to 4% of the property price.

Annual Maintenance Fees: Paid to developers or property management companies.

Rental Income Tax: Not applicable in most GCC countries, but consult a local advisor for updates.

Inheritance and Succession: Islamic inheritance laws may apply, so it’s wise to create a local will to manage asset transfer smoothly.

If you plan to sell your property later, ensure you understand exit regulations, including repatriation of funds and capital gains rules.

Navigating Middle Eastern property laws can be complex for foreigners. Partnering with a licensed real estate broker or a law firm specializing in foreign investments ensures your purchase process is smooth, transparent, and compliant.

They can assist with:

Legal document verification

Negotiations with developers

Bank financing and mortgage guidance

Residency visa processing

Buying property in the Middle East as a foreigner can be one of the most rewarding financial decisions you’ll make — offering strong returns, stable markets, and world-class infrastructure.

However, success lies in understanding the legal framework and following each step carefully. From verifying ownership rights to securing government approvals, every phase of the process requires due diligence and professional guidance.

By following these 7 crucial legal steps, you can confidently invest in Middle Eastern real estate, secure your assets, and enjoy the benefits of owning property in one of the world’s most rapidly developing regions.

Zohran Mamdani Elected New York City Mayor; Victory Celebration Features Bollywood Hit

Zohran Mamdani wins NYC mayoralty, the city's first Muslim and South Asian mayor; victory rally even

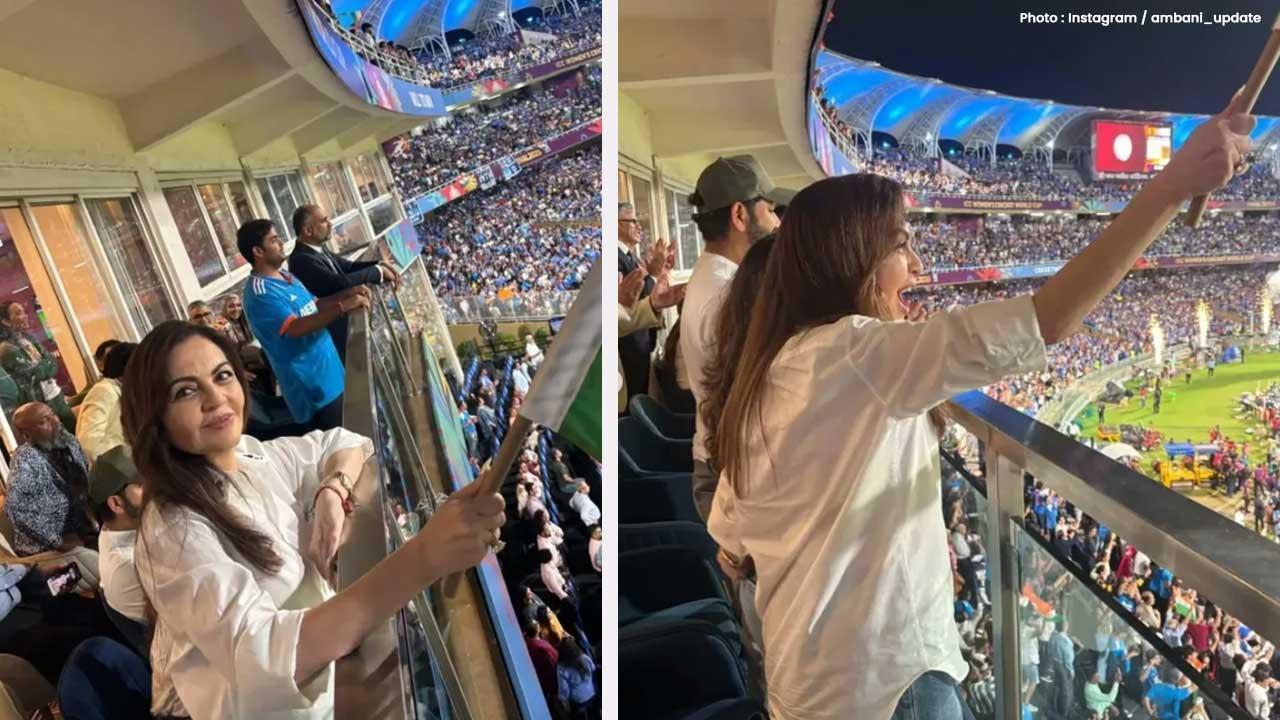

Nita Ambani Cheers India’s Women’s World Cup Triumph

Nita Ambani celebrated India’s Women’s World Cup win with grace and elegance, cheering proudly in st

Victoria Mboko Wins Montreal and Hong Kong Titles

Teen tennis star Victoria Mboko wins Montreal and Hong Kong titles, defeating Grand Slam champions a

Suns Defeat Spurs 130–118, Booker Leads with 28 Points

Devin Booker scored 28 points and 13 assists as the Phoenix Suns ended the San Antonio Spurs’ unbeat

Wolves Remove Coach Pereira After Poor Premier League Run

Wolverhampton have dismissed manager Vitor Pereira after failing to win any of their first ten Premi

Travis Head Leaves T20 Squad For Ashes Preparation

Australia’s Travis Head leaves T20 series against India to join Sheffield Shield for red-ball practi