Post by : Mariam Al-Faris

In a historic financial move, Saudi Arabia has launched a new investment tool called Saudi Depositary Receipts (SDRs) that allows local investors to buy shares of foreign companies listed on global markets—right from their local stock exchange. Announced on July 7 by Tadawul, the Saudi Exchange, this initiative enables international equities to be traded within the Kingdom and in Saudi riyals.

This is the first time depositary receipts are being introduced in Saudi Arabia's financial market. The move is seen as a major milestone in the Kingdom's efforts to become a global financial powerhouse under the Vision 2030 framework and its Financial Sector Development Program.

What Are SDRs and Why Are They Important?

SDRs are financial instruments that represent shares in foreign companies. They allow investors in Saudi Arabia to buy, sell, and hold stocks of major global firms—like Amazon, Apple, Microsoft, or Shell—without needing a foreign brokerage account or currency conversion.

In simple terms, an SDR lets a Saudi investor buy a piece of a global company while trading in Saudi riyals, through a local broker, and under local laws. This simplifies the process of accessing global markets for individual and institutional investors in the Kingdom.

Unlike traditional methods of cross-border investing, SDRs remove the hassle of foreign regulations, banking procedures, and currency exchange complexities, while still giving investors access to global growth opportunities.

The Mechanics Behind SDRs: How Do They Work?

SDRs function similarly to other global depositary receipts. When a foreign company’s shares are selected for SDR issuance, those shares are held by a custodian bank overseas, and matching SDRs are created and listed on the Saudi stock exchange. These SDRs can be traded just like regular Saudi stocks.

If investors want, they can even convert SDRs back into actual foreign shares and trade them in the international market, such as on the New York Stock Exchange or London Stock Exchange. This flexibility and liquidity make SDRs an attractive option for investors looking to diversify portfolios while staying within the local system.

A Major Step Toward Riyadh Becoming a Global Financial Hub

The launch of SDRs is more than just a financial upgrade. It’s a strategic leap in the Kingdom's long-term plan to modernize and globalize its capital markets. The Saudi Capital Market Authority (CMA) and Tadawul Group are working hand-in-hand to increase market efficiency, accessibility, and global integration.

Tadawul described SDRs as “highly liquid and flexible instruments,” enabling seamless conversion between the Saudi market and foreign exchanges. This feature allows foreign companies' shares to be co-listed and traded across two different financial markets—an important step for integrating Saudi Arabia into the global financial ecosystem.

The aim is clear: to position Riyadh as a financial center that rivals global giants like London, New York, and Hong Kong, in line with Vision 2030.

How SDRs Fit into Vision 2030 and Financial Reforms

Since the public listing of Tadawul Group, Saudi Arabia has introduced several reforms that have laid the groundwork for the launch of SDRs. These include:

Inclusion in Global Indices: Saudi stocks have been added to MSCI, FTSE Russell, and S&P Dow Jones emerging markets indices. This has made the Saudi market more visible and attractive to global investors.

Derivatives Trading: The rollout of equity and index derivatives allows for advanced hedging and investment strategies, attracting more sophisticated investors.

Simplified Foreign Investment Rules: The framework for Qualified Foreign Investors (QFIs) has been revamped to attract global capital and make entry easier.

Accelerated IPO Pipeline: A growing number of companies across diverse sectors are going public, boosting market depth and investor options.

The launch of SDRs now builds on these reforms, helping Saudi Arabia not just keep up with global standards but set new benchmarks in regional financial leadership.

Benefits to Local Investors: Global Access with Local Ease

The introduction of SDRs provides unprecedented benefits for individual and institutional investors in Saudi Arabia. Here’s how:

No Foreign Accounts Needed: Investors can now buy global stocks using their existing Tadawul accounts—no need to go through the lengthy process of setting up foreign brokerage services.

Domestic Legal Protections: Since SDRs are traded locally, all transactions are subject to Saudi Arabia’s financial laws and regulations, ensuring security and transparency.

Diversified Portfolio Options: Investors can balance their portfolios with exposure to global tech, industrial, and energy sectors—without the complexities of currency conversions or overseas risks.

Use of Saudi Riyals: All transactions happen in local currency, removing the need for foreign exchange and offering simplicity for retail investors.

Easier for New Investors: For those just starting to invest or those not familiar with international markets, SDRs provide a user-friendly gateway to global investing.

Impact on the Broader Economy and Market Confidence

This development is also expected to boost market participation, enhance liquidity, and attract foreign attention. Local investors will have new tools to grow their wealth and learn global market behavior, while international companies gain an entry point into Saudi Arabia’s growing investment community.

This also signals a broader confidence in Saudi Arabia’s market infrastructure. By enabling such a technically advanced financial product, the Kingdom is showing that its financial systems are modern, secure, and competitive on a global scale.

Global Companies Eye Saudi Investors

The new SDR framework could also encourage more international companies to participate in the Saudi market by issuing SDRs for their shares. This opens a two-way door:

Saudi investors get global access, and

Global companies tap into Saudi capital and investor base.

It’s a win-win scenario that expands Saudi Arabia’s financial network, making the Kingdom a bridge between global financial hubs and Middle Eastern markets.

What This Means Going Forward

The launch of SDRs is expected to transform how investing is done in the Kingdom. As Tadawul continues to develop new products and improve access, Saudi Arabia is moving closer to becoming a fully globalized financial market.

This innovation may pave the way for even more financial products, such as ETFs linked to international indices or baskets of global SDRs. It also reflects the government's serious commitment to creating a diverse, robust, and inclusive financial system.

A Historic Leap in Saudi Financial Markets

The debut of Saudi Depositary Receipts is not just a new financial feature—it’s a turning point in Saudi Arabia’s journey toward global financial integration. By giving local investors direct access to global companies, all while keeping everything within the Kingdom’s market and legal framework, SDRs perfectly embody the spirit of Vision 2030.

Saudi Arabia is no longer just participating in global markets; it is shaping how regional markets interact with the world.

Globe Soccer Awards 2025 Finalists Include PSG and Cristiano Ronaldo

GLOBE SOCCER Awards 2025 finalists are out after 30 million fan votes, with PSG stars, top clubs and

Google Gemini Web App Adds Opal Tool for Building Mini AI Apps

Google adds Opal to Gemini web app, letting users make mini apps called Gems using simple prompts wi

Shraddha Kapoor Praises Crew Behind Dhurandhar Film Success

Shraddha Kapoor praises the unseen technicians of Dhurandhar, lauds director Aditya Dhar, and calls

Truecaller Launches Free AI Voicemail with Spam Protection for Android

Truecaller launches free AI voicemail for Android in India with instant transcription, spam protecti

FIFA Confirms First Women’s Club World Cup Scheduled for 2028

FIFA announces the first Women’s Club World Cup in January 2028 with 16 teams, group stages, and glo

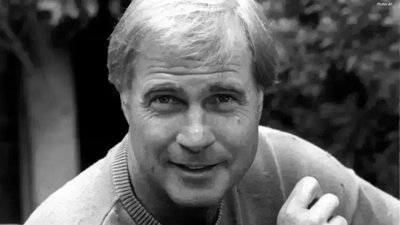

Buck Rogers Star Gil Gerard Dies at 82 After Cancer Battle

Gil Gerard, famous for playing Buck Rogers, has died at 82 after cancer. He was known for his sci-fi